Blog

“Stocks have a Case of Bad Breadth“

‘Market-breadth’ refers to the number of companies responsible for driving the returns of the overall market. If a small number of companies account for the vast majority of the market’s (or an index’s) return over a period of time, the market lacks breadth and market leadership is often referred to as being ‘narrow’. The same is true of the opposite scenario; if a large number of companies are driving market performance, market leadership is referred to as “broad”. The first three quarters of 2023 were an anomalous period in market history, during which the five largest US listed companies by market capitalization were responsible for 67.18% of the return of the S&P 500 Index. In other words, only 1% of the companies in the S&P 500 Index were responsible for over two-thirds of the returns during the first nine months of the year.

The seven largest US listed companies by market-cap, which have been dubbed the “magnificent seven” by many in the investing world, were responsible for 84.31% of the YTD returns of the S&P 500 Index through 9/29/2023. Those seven companies (in order of market-cap) are: Apple, Microsoft, Alphabet (Google), Amazon, NVIDIA, Tesla, and Meta Platforms (Facebook).

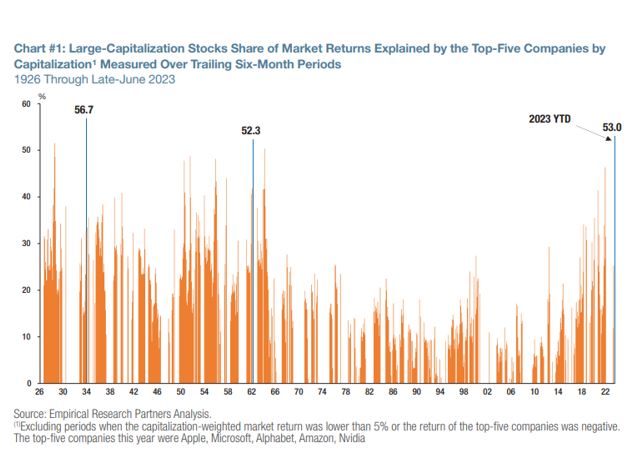

The last (and only other) time five companies accounted for such a large percentage of market returns over a six-month period occurred in the early 1930’s. For perspective, since January of 1926, the average contribution to the prior six months of market* returns attributable to the top five largest companies is substantially lower, averaging only 18.61% over the period from January 1926 – June 2023.

The chart above shows the percentage of market returns over the previous six months which can be explained by the top-five companies by market-cap dating back to 1926. Unlike the prior examples which referred to the S&P 500 Index and showed nine month returns, the chart uses data from the top-750 largest US listed companies by market-capitalization using six month returns.

Now that we’ve put the first half of 2023 into historical context, let’s address the burning question: where might markets go from here?

Logically, there are only a few scenarios that could play out, which are: the largest stocks in the market pull back to be more in line with the broader market, the remainder of the market begins to catch up to the largest stocks which have driven the bulk of market returns YTD, some combination of those two scenarios, or the least likely scenario – the largest stocks continue their streak of dominance over the rest of the market into the foreseeable future.

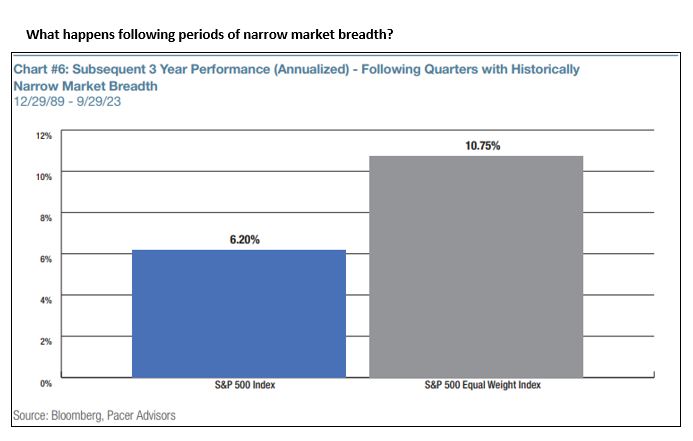

In the subsequent three years following periods where the market’s return was particularly narrow, the S&P 500 Equal weight Index outperformed the Market cap weighted S&P 500 Index by an average of 4.55% (annualized). The outperformance of the Equal weight Index over the Market cap weighted Index is relatively consistent, with the Equal weight Index outperforming 82.4% of the time. The only three quarters in which the market-cap weighted S&P 500 Index outperformed the S&P 500 Equal weight Index over the subsequent three-year period occurred following Q2 & Q4 of 1997, and Q3 of 2018.

To put that into context, the only times the S&P 500 Equal weight Index failed to outperform the Market cap weighted Index over a three-year period following quarters with narrow market leadership, occurred following two quarters at the very beginning of the dot com bubble, and once late in 2018, which was followed by a historic period of dominance by mega-cap technology companies. This serves as an important reminder to investors: periods which seem anomalous while you’re living through them can (and often do) last longer than expected. However, it’s also a useful reminder that, generally speaking, those periods don’t last forever, and when the other shoe finally drops, historical data suggests the snapback has tended to be aggressive in the opposite direction.

Stay Diversified

The key takeaway for me isn’t so much that a few companies have dominated the market performance so far this year, but to stay focused on fundamentals and remember that diversification and investing ACROSS the entire market is important. If you’ve been doing that with ONLY a market cap weight S&P 500 index fund then you are likely less diversified than you think given the outsized returns of the top performing companies in 2023.