Blog

2022 was Tough; What’s the Outlook for 2023?

Investors just went through one of the toughest investment years in history. This was quite a change from 2019, 2020, and 2021 which saw strong stock and bond returns despite the pandemic. The question on everyone’s mind is: “2022 was tough, will 2023 be better for investors?”. I don’t like “year-ahead outlook” reports. I’ve read many of them over the years and they’re often obsolete by the end of January. That being said, I think it’s important to appreciate just how unique 2022 was, and convey what’s on our mind as we look to 2023.How Bad was 2022 Compared to History?

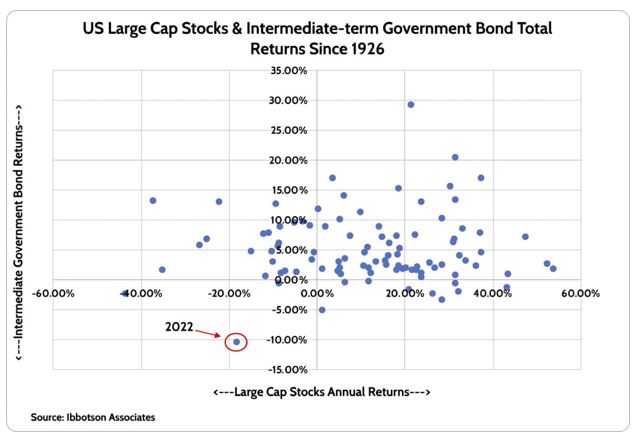

Stock investors have endured several years worse than what we saw in 2022. The S&P 500 index just averted bear market territory by finishing 2022 down by almost 19%. There have been a half-dozen years worse than 2022 for the S&P 500 since 1926. However, what was truly unique about 2022 for investors is the performance of bonds. We have total return data for intermediate-term U.S. Government bonds going back to 1926. By “intermediate-term,” this references bonds that mature in 5-7 years. For these bonds, 2022 was the worst year ever! Yes, EVER! When we combine annual stock and bond returns on a scatter plot, you can see that 2022 was truly an outlier. Why did bonds have such a terrible year? It’s all because of the ‘unconventional’ monetary policy the Federal Reserve and other global central banks have engaged in since the Great Financial Crisis of 2008. By aggressively buying bonds as part of their Quantitative Easing policy, they pushed interest rates to some of their lowest levels ever. Another way to put this is that the Fed artificially boosted bond prices, which benefitted investors and borrowers for many years.

Why did bonds have such a terrible year? It’s all because of the ‘unconventional’ monetary policy the Federal Reserve and other global central banks have engaged in since the Great Financial Crisis of 2008. By aggressively buying bonds as part of their Quantitative Easing policy, they pushed interest rates to some of their lowest levels ever. Another way to put this is that the Fed artificially boosted bond prices, which benefitted investors and borrowers for many years.

Will the Fed “Pivot” and Stop Raising Rates?

The most common topic in the market today is when the Fed will stop hiking interest rates. Most participants think they will hike at least 1 to 2 more times in 2023 and then stop. What comes after this anticipated pause in rate hikes is the real question. The vast majority of today’s investors only know one way of doing things: the economy goes into recession, the Fed cuts rates aggressively, and stocks go up. That’s been the playbook for over two decades. My thesis is that it’s not that simple this time because of the inflation problem we have. Sure, the inflation rate will come down in 2023 as supply chains normalize and we lap some of the huge inflation we saw in 2022. But I don’t think we’re going back to a world of 1-2% inflation soon. The biggest challenge the Fed has economically and politically is the jobs market. They know full well that strong wage growth leads to higher future inflation. And that’s exactly what we’re seeing with extremely strong wage growth, particularly for those in the bottom half of wage earners. This puts the Fed in a difficult position. If they pause rate hikes and the economy continues to hum along with low unemployment, then future inflation is likely to be higher because of strong wage gains for workers. Then what? Let’s speak the truth out loud: The Fed wants people to lose jobs so the labor market loosens up, wage growth slows, and inflation falls back to their made-up “target” of 2% inflation. That’s the unvarnished truth, something you’ll never hear out of their mouths because of the political firestorm that would ensue. The risk I see for the market in 2023 is that the Fed will be forced to hike rates higher than 5.0% and keep them there for longer than investors expect. Bond investors are baking in interest rate cuts of 1.00% by the middle of 2024. I’m not one to fight the market. But that seems hopelessly optimistic absent a severe recession and spike in the unemployment rate. A potential recession and the path of Federal Reserve policy are the two headwinds that stock investors face in 2023. If the economy is strong and a recession doesn’t happen, then the Fed will keep rates high, which is a headwind for stocks. But if a recession happens, then stocks would struggle with the drop in company profits.Will 2023 Be Better for Investors?

Given the caution above, it’s no surprise that we continue to take a cautious approach with client investments. Using cash as a strategic investment allocation tool will continue into 2023 highly competitive interest rates. The ‘cost’ of sitting in cash is a lot lower than what it was when everyone was earning 0% on their savings. On the stocks side of the ledger, we think being nimble in adding & reducing stocks exposure will be the name of the game. Markets have proven quite volatile and given the economic uncertainties out there, we wouldn’t be surprised to see that continue. Stocks are not a screaming value, to be frank. A lot of the large cap technology fluff that surged in 2020 and 2021 came down dramatically in 2022. However, that doesn’t mean those stocks are cheap. Value will emerge across the investment landscape at some point. And we’ll be happy to “go long” when that happens. But for us, protecting our clients is job #1. Your dreams, your goals, your financial life are not to be trifled with. We can’t guarantee anything for clients. But we can give it our all every day to serve your needs and goals as best as possible.Copyright © 2025

Van Gelder Financial