Blog

“Is Social Security Really Going Bankrupt?“

Unless you’re living under a rock, you’ve heard some version of the statement that social security is running out of money and that we shouldn’t be counting on it for future retirement income. While there are certainly things that need to be fixed about social security (and our ability to manage debt as a country), I actually don’t think the situation is quite as dire as the headlines would make us believe. I thought this recent article from Ben Carlson did a great job of explaining exactly when we could expect to see cuts in social security benefits as well as some likely solutions that Congress would take before letting benefits get reduced. Happy Reading!

It sounds dire.

I know a lot of young people who feel the same way. There is too much government debt. Politicians won’t do anything to fix the entitlement shortfalls. The boomers are going to leave the cupboards bare.

Insolvency sounds scary but the situation is not quite as grim as the headlines would have you believe. I went through the actual report. Here’s what I found:

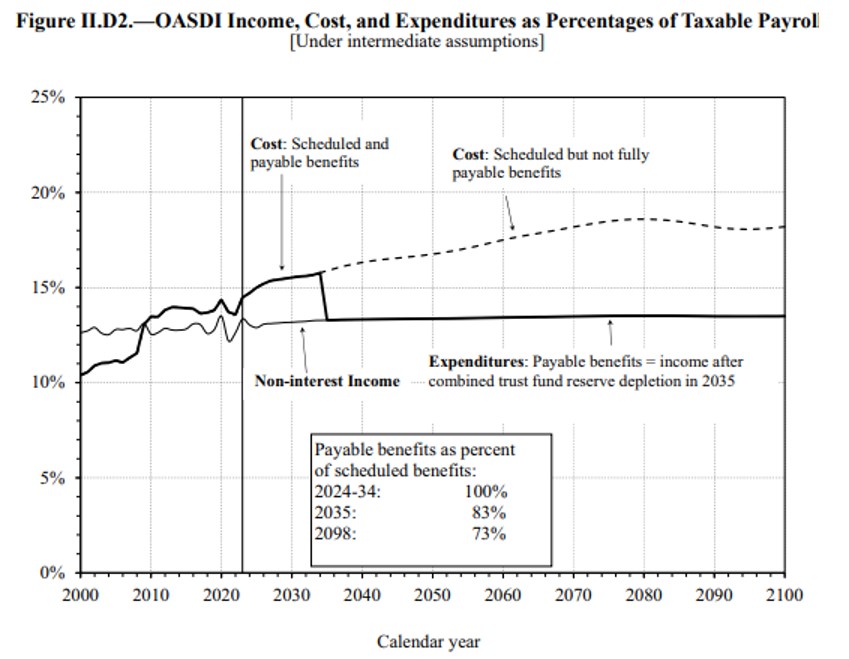

If Congress does not act by 2035, the trust fund reserves are projected to be depleted. However, the income from Social Security taxes would cover 83% of scheduled benefits.

While it is true that more money will be going out than coming in, the shortfall is only 17 cents on the dollar. So it’s not like there will be no coverage at all.

Now look at the chart they produced that takes things out even further:

By the year 2098, when I will be turning 117, they project the tax revenue will cover 73% of the benefits. That’s a long runway to shore things up.

There are three potential scenarios when thinking about these numbers:

(1) People should get used to the idea of their Social Security benefits getting slashed starting in the 2030s.

(2) Politicians still have time to act but taxes might be going up to avoid any shortfall.

(3) The U.S. government likes to spend money, we print our own currency and we will simply go into more debt to cover the shortfall.

If I had to guess, I would assume some combination of (2) and (3) makes sense. No politician in their right mind would slash Social Security benefits for retirees. You don’t win votes that way.

They could raise the tax limits for high-income earners or increase the filing age for younger people. Those fixes make sense to me.

Who am I kidding? We’ll probably just kick the can down the road and increase government debt (or decrease spending elsewhere). One of the lessons from Covid is if there is a political will for more spending, it will happen. The only constraint you have when you print your own currency is inflation.

There are no guarantees when it comes to the actions of politicians, but Social Security is the most important retirement plan ever enacted in America.

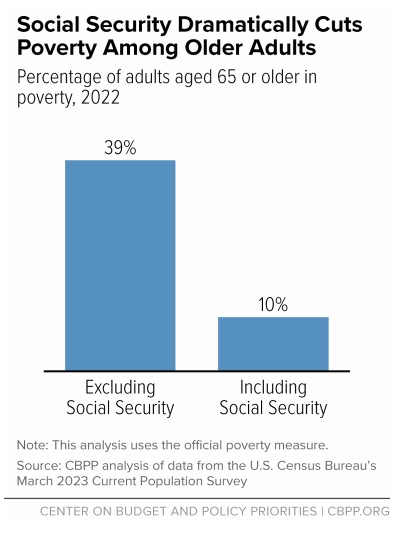

According to the Center on Budget and Policy Priorities, nearly 23 million adults and children would fall below the poverty line in the U.S. without Social Security. That includes nearly 17 million people 65 or older and almost 1 million children.

Without Social Security, 4 out of every 10 senior citizens would be in a life of poverty:

To some people, Social Security is a supplement to other sources of income. To others, it’s one of their main sources of income.

Social Security is not bankrupt. Things will be fine as long as people keep paying Social Security taxes. The government will figure something out or prioritize this plan.

If they don’t, a lot of people will struggle to afford their retirement years.