Blog

“The Fed Cut Rates…Now What?”

Please enjoy this recent article from Pramod Atluri at Capital Group

The U.S. Federal Reserve has finally arrived at the rate-cut party.

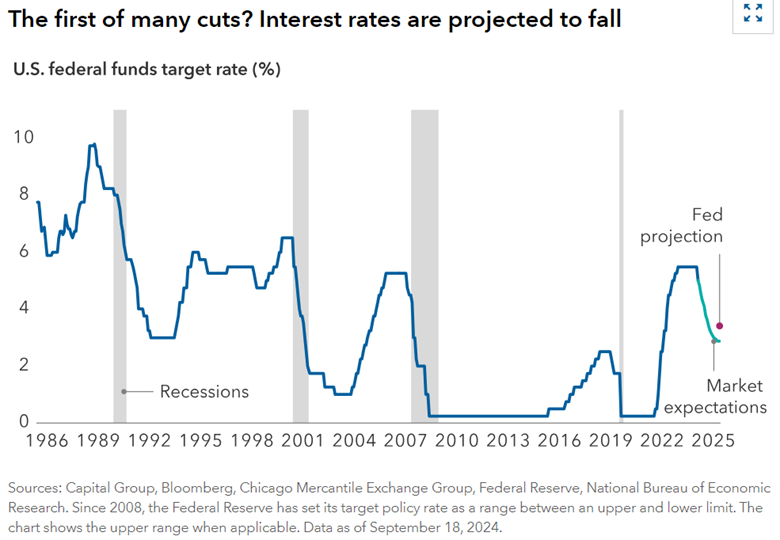

Officials at the central bank lowered interest rates 50 basis points to 4.75% to 5.00%, the first cut since March 2020, when the COVID-19 pandemic shuttered most of the world’s economy. Although households, companies and governments hurt by high borrowing costs may cheer the move, investors are now faced with the challenge of figuring out what’s next.

“Historically, when the Fed starts to cut it’s a red flag. Rate cuts take a long time to flow through the economy, so it’s less about the rate changing and more about what the Fed sees and what the economy is doing,” says Caroline Jones, portfolio manager for CGUS — Capital Group Core Equity ETF and The New Economy Fund®. “The language from Fed Chair Jerome Powell is just as important, and he struck a balanced tone consistent with a soft landing.”

The Fed has now joined other major central banks including the European Central Bank, which began the process of lowering rates in June and did so again in September as inflation declined. Worldwide, policymakers are grappling with growth concerns, though Europe’s economy is more stagnant.

Many investors, including Jones, don’t expect a recession in the U.S. as the most likely outcome. “However, the pandemic and ensuing monetary tightening campaign to curtail inflation created unusual distortions, so everything feels messier,” she adds. Coupled with a rate cut in the thick of a presidential campaign, investors are likely to face some market volatility in the months ahead. “Now that we have the first rate cut, investors in the market are likely to start positioning for the election as the next big event.”

For their part, bond investors project the fed funds target rate will land around 3.0% by December 2025. Is that too little, too much, or just right?

“I don’t often agree with the consensus, but this time it feels about right,” says Pramod Atluri, principal investment officer for The Bond Fund of America® and portfolio manager for CGCB — Capital Group Core Bond ETF. If inflation falls to the Fed’s 2% target as expected, then a policy rate of around 3.0% appears reasonable absent a recession.

The economy is cooling rather than cracking

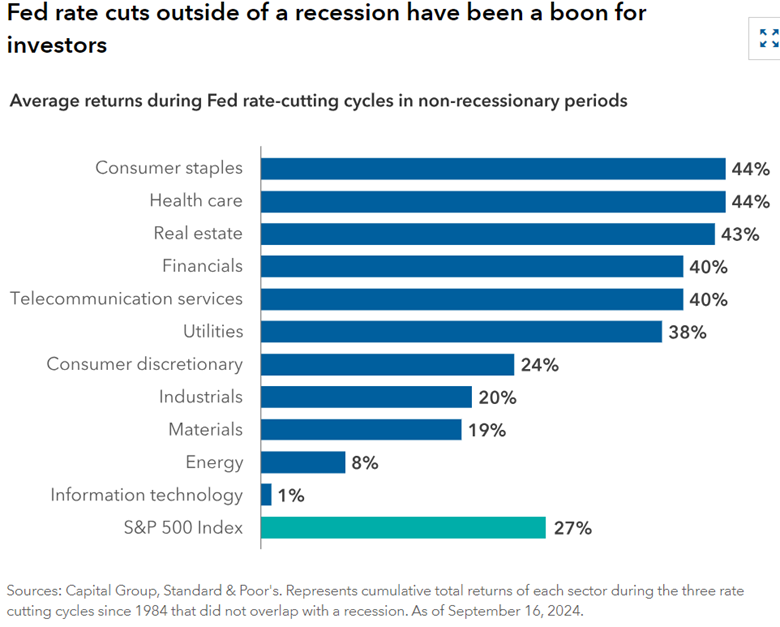

Rate cuts have happened when the economy is growing.

Of the seven rate-cutting cycles since 1984, three occurred outside a recession. In those non-recessionary cuts, the S&P 500 Index averaged a 27% return from the first rate cut to the last. During that same period, nearly every sector posted double-digit gains.

If the Fed has its way, this cycle would be the fourth outside of a recession.

So far, evidence of economic stability abounds. For example, the unemployment rate eased slightly from 4.3% in July to 4.2% in August. This figure is higher compared to the 50-year low of 3.8% achieved last year but doesn’t indicate a sharp turn in the labor market. The country also continues to hire, with 142,000 jobs added in August — lower than expected but still positive.

Meanwhile, U.S. gross domestic product, adjusted for inflation, rose at a 3.0% annual rate in the second quarter of 2024, according to the Commerce Department. The Atlanta Fed’s GDPNow model estimate for third quarter GDP growth is 2.5%, as of September 9.

Economic growth appears to be broadly moderating toward the long-term potential growth of the U.S., which our economists estimate to be just below 2%, according to Atluri. As growth slows, there’s a higher risk that any shock could push the U.S. economy closer to a recession. “I believe the economy is slowing, but not weak. We are still growing at a healthy pace. Over the next year, I expect growth of around 2%, which is at or above potential,” he adds.

The “rolling” recession phenomenon, marked by various sectors of the economy going through business cycles at different rates, has helped keep the overall economy on solid ground, Jones says. This is true even as companies such as budget-friendly retailer Dollar General sound the alarm on weaker spending by their core customer base of lower income consumers.“When companies talk about slowing demand, it’s because they’re seeing weaker revenue growth,” Jones explains. “Part of that is because inflation is coming down, especially in goods versus services where pricing tends to be stickier. In aggregate, total consumer spending — including things like health care and utilities — has continued to grow, even once adjusted for inflation.”

The upside of falling rates

Another reason for economic optimism? High-income consumers remain confident. “They have jobs, stock prices are up, their homes have been rising in value, and they’ve been taking trips to Europe,” Jones says. The S&P 500 Index is up nearly 18% year to date through September 18.

“Lower rates should help some of the more interest rate sensitive sectors of the economy like housing, autos, consumer lending and the battered commercial real estate sector. These positive impulses could offset the gradual slowing in the labor market to maintain the conditions for an economic soft landing,” Atluri adds.

Yet a swift recovery for big-ticket, one-off purchases such as homes may be unlikely. “Anyone that had an inkling to move closer to family or take advantage of near-zero interest rates moved during the pandemic,” Jones says. “Inventory of homes for sale remains very low, and house prices are at an all-time high. Thus even with slightly lower rates, affordability remains a challenge, and home owners with 3% mortgages will still be reluctant to move.”

Against this backdrop, Jones sees opportunities in companies that offer steady earnings potential through most economic cycles but aren’t considered purely defensive. For example, earning potential for a payroll company like Automatic Data Processing (ADP) tends to increase alongside economic growth and has been less impacted by downturns than more cyclical industries because of its historically recurring revenue stream.

The same goes for certain health care companies, including drug distributors and some medical technologies, because demand for their products tends to remain steady. Health care companies overall have been slow to normalize post-pandemic. Election-related regulatory oversight has also weighed on valuations, making them attractive.

Megatrends such as artificial intelligence remain relevant in any business cycle. “I think AI is the biggest technology revolution since the internet, and it will be a huge source of efficiency gains for companies,” Jones says. That in turn could herald a strong period of overall growth — not unlike the technology-powered economic growth of the 1990s. Exactly when these efficiency gains could happen is difficult to pinpoint, and there could be pockets of stock market volatility along the way, but Jones believes “the potential is compelling.”

Bonds are back

What is clear is that rate cuts will likely lead to lower cash yields than the 5.0% or so money markets have offered to date. If the Fed cuts rates as much as markets expect, cash yields could quickly drop to under 3.0% over the next year. Faced with the prospect of lower returns on cash, investors have begun to pile into high-quality bond funds in 2024.

The current environment offers decent return potential for fixed income. “Inflation is falling, and the Fed has pivoted its attention to support growth, which is usually an attractive time for bonds,” Atluri says.

With inflation nearer to a 2% target, the Fed has ample room to cut rates even faster — more than current market expectations — should a growth shock occur and recession risk grow. Historically, bonds have been at their strongest in periods of rate cuts since bond prices rise as yields fall. Average returns for the Bloomberg U.S. Aggregate Index have sharply outpaced cash proxies in rate-cutting periods between September 1984 and September 2024.

Because bonds have often zigged when stock markets zagged, investors stand to benefit. That’s what happened when equity markets plunged in August and bonds posted gains, though there is no guarantee that history will repeat. “We’re hitting a momentary period of calm with interest rate volatility, but the Fed can’t eliminate the business cycle. Now is a good time for investors to consider upgrading their portfolios to higher quality bonds, which continue to offer solid income and return potential with likely greater diversification benefit,” he concludes.

Disclosures:

Past results are not predictive of results in future periods.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

Capital Client Group, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.