Blog

“Mid-Year Stock Market Outlook“

It’s hard to believe we are already at the halfway point of 2024! There are always a lot of question marks coming into a new year, however with numerous global elections already completed and a contentious US election in November this year was especially “unknown”. The good news is that so far in 2024 the S&P 500 is up just over 13% (Through 6/11/2024) and the Nasdaq is up over 17% during that same time period. What is on the horizon as we look out to the second half of 2024 and beyond? We really like this recent article from American Funds that talks about three key themes they are focused on in the stock market as we move into the second half of 2024. Enjoy!

After a strong rally in the first half of the year, stocks appear to be headed into the second half with a powerful tailwind and an even brighter outlook. While the risks of a stumble remain ever present, healthy consumer spending and robust corporate earnings underpin an optimistic view at the midpoint of 2024.

In the face of lingering inflation, the U.S. economy continues to flex its muscles. Labor markets and company fundamentals remain healthy. Wall Street analysts expect earnings for companies in the S&P 500 Index to grow more than 10% this year, with further acceleration in 2025.

Outside the U.S., earnings growth in Europe is anticipated to be substantially lower, albeit still in positive territory. In emerging markets, economists are calling for a sharp rebound in profits after a decline in 2023. Even in China, where a slow economy has cast a long shadow, there are early signs of a turnaround in some industries.

We expect solid economic growth for the remainder of this year and through 2025. This likely leads to an environment of expanding earnings growth across industries and sectors. This, in turn, should lead to a broadening market rally as profit growth is a primary driver of returns.

What’s more, equity market valuations don’t appear to be particularly stretched. Price-to-earnings ratios for most markets were near or modestly above their 10-year averages as of April 30, 2024.

To be fair, there are risks for markets and investors. Inflation is falling but remains uncomfortably high. The timing of any interest rate cuts by the U.S. Federal Reserve is unclear. Tensions between the U.S. and China have heightened, and war continues in Ukraine and the Middle East. Market declines are inevitable, but over time markets have trended higher, attaining multiple fresh highs in a given cycle.

That’s why we focus on identifying powerful forces for growth — concepts like innovation, productivity and the reshoring of supply chains. We have always had downturns, but they haven’t changed the historical long-term trajectory. Here are three key themes we are focused on.

1. AI opportunity is stacking up in tech and beyond

With its open-ended potential to transform industries and how people do their work, artificial intelligence represents compelling investment opportunities. This has led to great enthusiasm for the stocks of tech giants pioneering AI.

For investors, key to success will be identifying the potential winners. This starts with understanding the AI “stack” — four layers of technology that enable AI to operate. Companies are jockeying for position at each layer: semiconductors, infrastructure, applications and the AI models themselves.

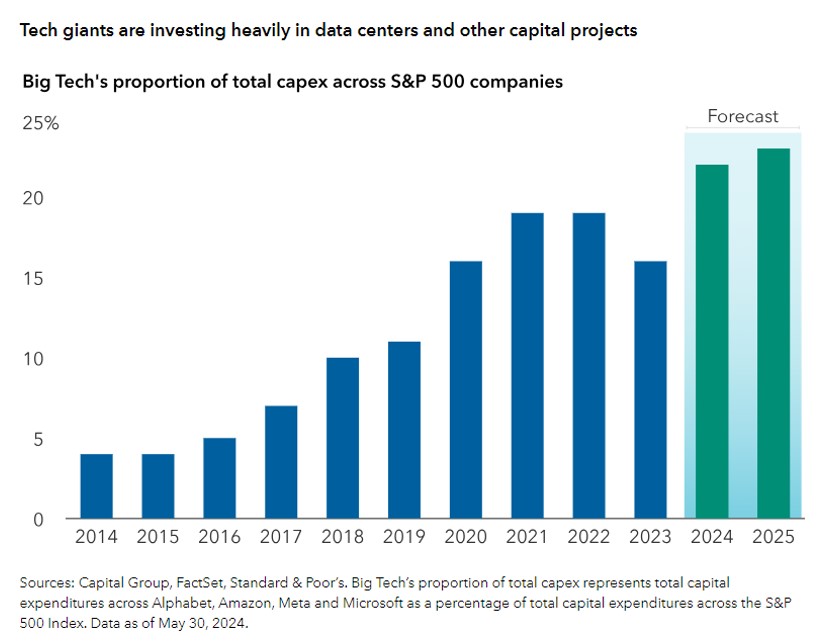

Alphabet, Meta and Microsoft have invested tens of billions of dollars to dominate multiple layers of the stack. This includes aggressive investment to develop models, build out cloud infrastructure and develop advanced chips. Although these companies are spending money on their own processors, leading chipmakers currently maintain their market share dominance.

While we believe AI is exciting and will have a major impact on how we work and live, it is a product cycle and will be subject to the same laws of economics and investor emotions that we see in other product cycles. We saw similar patterns in the late 1990s with the expansion and explosion of the tech and telecom bubble. While we do not believe we are in a bubble today, there is a good chance we will see a pullback for some of these stocks.

We are studying each layer of the stack to determine which companies we believe have the best chance of being winners. At certain layers this is relatively straightforward because few companies have the technical and financial wherewithal to compete successfully.

The AI opportunity reaches far beyond tech companies. The need for a massive build-out of data centers is driving demand for Caterpillar’s construction and engineering equipment, for example. Because AI data centers require vast amounts of electricity, the build-out will also drive demand for a range of energy sources. Because several tech giants have committed to net zero carbon emissions, the use of nuclear power could grow. In June 2023, for example, Microsoft struck a deal with Constellation Energy to supply one of its data centers with nuclear power.

2. There is ample opportunity outside the U.S.

The Magnificent Seven stocks closely associated with AI and other tech trends aren’t the only place to find solid investment opportunities. Outside the U.S., there’s a growing list of rivals with leading businesses.

For example, the seven leading contributors in 2023 within the MSCI EAFE Index, a broad measure of developed markets in Europe and Asia, have outpaced their U.S.-based cohort since the beginning of 2022, rising more than 40%. The non-U.S. companies represent a wide range of industries.

We have seen a market that is expanding beyond the Magnificent Seven. The re-rating, or increasing share prices, of industries is broadening and rolling through the global equity markets. But with re-rating comes higher valuations, so as active investors we must be wary of groups of stocks associated with market trends and focus on the prospects of individual companies to deliver top-line growth. And, rather than concentrate on one admittedly dynamic region such as the United States, it makes sense to think globally in the hunt for companies with dominant market positions and strong potential demand for their offerings.

3. Tech leaders are reshaping the dividend landscape

Long regarded as the domain of mature industries with slowing growth prospects, dividends are gaining favor among information technology giants. Meta, Alphabet and Salesforce all introduced dividends in the first half of 2024, and those announcements appear to be shifting the narrative.

Meta and Alphabet’s dividends can be viewed as a signal of capital discipline among tech innovators and a commitment to shareholder returns. Tech companies accounted for 14.1% of total cash dividends paid by S&P 500 companies in 2023, making them the second largest contributor by sector in dollar terms.

Although dividend yields for many tech firms are modest, the dollar amounts are massive, and we expect continued strong earnings growth both this year and in 2025. Going forward, a broadening opportunity for economic growth should create the potential for improved earnings growth among dividend-paying companies. That can create opportunities for dividend-oriented strategies to generate income and to participate more fully in market appreciation.

For investors seeking current income, technology, aerospace and energy companies have been introducing or increasing dividends.

Bottom line

Given the prospects for solid global growth and healthy fundamentals, equity markets are broadening. While U.S. stock markets are likely to do well, they likely won’t be the only source of superior returns. But with questions lingering over inflation, rates and global trade, selective investing will be critical.