Blog

“Should You Buy at an All Time High?”

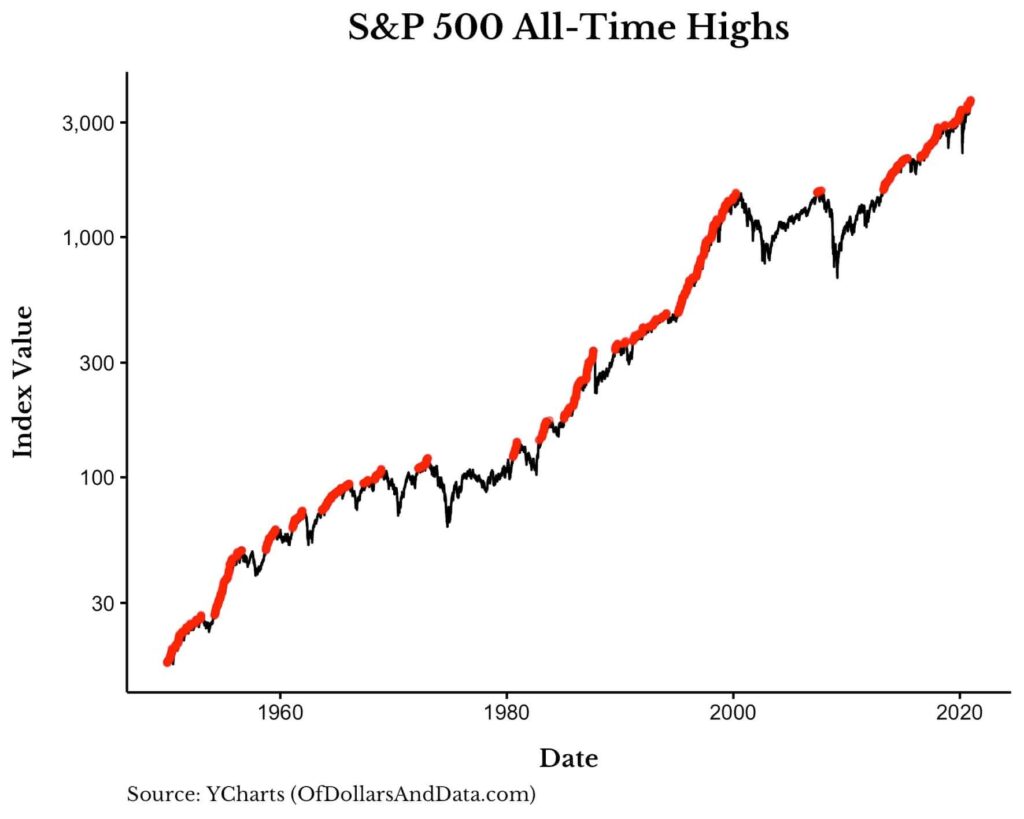

Following the sharp market declines in early 2020 due to COVID, the stock market has been on quite a tear. The S&P 500 actually finished 2020 up over 16% and is currently up approximately 3.5% already for 2021. With many parts of the country (and world) still deeply affected by the pandemic, you may be wondering if now is a good time to buy into the stock market? After all, nobody wants to deploy their money right before a crash or correction takes place. Certainly, buying near all-time highs doesn’t feel like we would be getting the best “bang for our buck”. Many people are wondering whether we are in a “bubble” and whether waiting on the sidelines with cash is the right move. While I certainly cannot predict the future or what the stock market will do, we will explore why buying when the market is high isn’t actually as bad as we may think. All Time High’s are Usually Bullish Indicators When we think about all-time highs it can be easy to associate them with fear. All-time highs represent uncharted territory and something that is unknown and scary right? However, when we hear “all-time highs” we should simply associate it with the fact that more buying than selling. In fact, that is exactly how markets work. When more money is trying to get into an asset (stocks) than trying to get out, then prices naturally rise. If that behavior continues to happen, then prices rise further, and we see something happening which is that all-time highs are usually quickly followed by new all-time highs. The chart below shows red dots each time the S&P 500 has reached all-time highs since 1950. As you will notice, there are large periods of time where markets trend upwards and where new all-time highs are quickly followed by the next all-time high. What About Performance?

You may be thinking that it’s interesting to look at some red dots and see that all-time highs do occur fairly regularly. However, what if I invested right after an all-time high? What would my performance actually look like? In that same time period since 1950, if someone were to invest when the market is within even 5% of a previous all-time high then they would return an average of 8.2% the following year.

Perhaps even more compelling is considering that if you invested into markets within 5% of all-time highs then your returns over the next three years was actually HIGHER than if you had waited to invest when the market wasn’t close to an all-time high. Of course, we have no way of knowing if that trend will continue, but perhaps this historical data can provide some level of comfort for those considering buying into the market now.

The Bottom Line

Regardless of which riskier asset classes you have in your portfolio, as this post illustrates, buying near all-time highs should not be a cause for concern. Of course, you may get unlucky with an asset class during a particular period of time, however, if you own a diversified portfolio, the impact of such an occurrence would be tempered.

As investors our goal is to grow our wealth so that we can live the life we want. Unless you are investing your entire nest egg into one asset class at a market peak, it is unlikely that buying near an all-time high will ever prevent you from living the life you want.

What About Performance?

You may be thinking that it’s interesting to look at some red dots and see that all-time highs do occur fairly regularly. However, what if I invested right after an all-time high? What would my performance actually look like? In that same time period since 1950, if someone were to invest when the market is within even 5% of a previous all-time high then they would return an average of 8.2% the following year.

Perhaps even more compelling is considering that if you invested into markets within 5% of all-time highs then your returns over the next three years was actually HIGHER than if you had waited to invest when the market wasn’t close to an all-time high. Of course, we have no way of knowing if that trend will continue, but perhaps this historical data can provide some level of comfort for those considering buying into the market now.

The Bottom Line

Regardless of which riskier asset classes you have in your portfolio, as this post illustrates, buying near all-time highs should not be a cause for concern. Of course, you may get unlucky with an asset class during a particular period of time, however, if you own a diversified portfolio, the impact of such an occurrence would be tempered.

As investors our goal is to grow our wealth so that we can live the life we want. Unless you are investing your entire nest egg into one asset class at a market peak, it is unlikely that buying near an all-time high will ever prevent you from living the life you want.

Copyright © 2025

Van Gelder Financial