Blog

“Roger Federer vs. the Stock Market“

If someone has a large amount of money to invest, it can sometimes be easier psychologically to put that money to work slowly over time. In other words, rather than investing $500,000 in one day, it can feel better to invest $100,000 per month over a 5-month period.

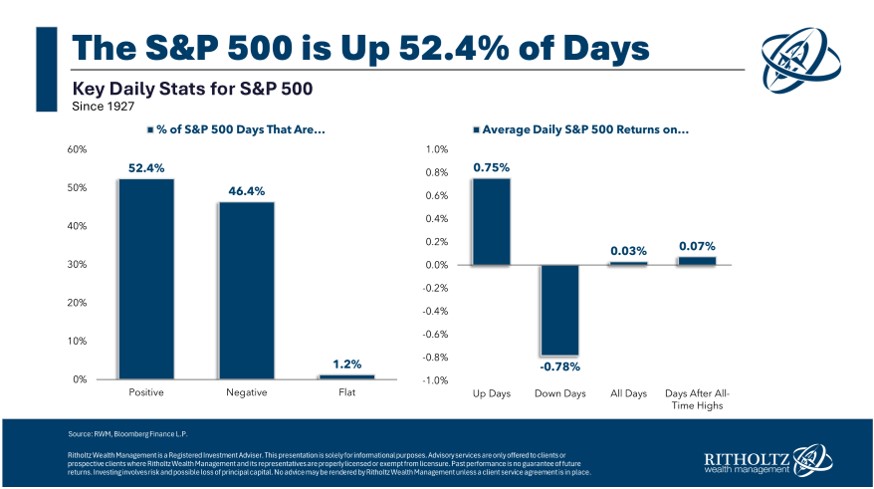

This concept is known as dollar cost averaging and while that might help psychologically, does it actually improve performance? Of course, the answer depends on many factors of what is happening on the stock market at any given moment but it is important to know that over the past 100 years, on any given day in the S&P 500, it is up only 52.4% of the time. That maybe doesn’t sound that great. The converse means that on any given day the index is either flat or down 47.6% of the time. However, it’s important to remember that this very slight edge of being “positive” for any given day vs. “negative” has produced average ANNUAL market returns over the same time period of 10.62%! Keeping that long term outlook is so important.

A similar concept was recently on display in Roger Federer’s commencement speech at Dartmouth. Ben Carlson of a Wealth of Common Sense did a great job highlighting this speech and comparing his tennis career to how the stock market has performed. Enjoy this reading!

Roger Federer delivered an excellent commencement address at Dartmouth’s graduation recently.

This part floored me:

In tennis, perfection is impossible… In the 1,526 singles matches I played in my career, I won almost 80% of those matches… Now, I have a question for all of you… what percentage of the POINTS do you think I won in those matches?

Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play.

When you lose every second point, on average, you learn not to dwell on every shot.

You teach yourself to think: OK, I double-faulted. It’s only a point.

OK, I came to the net and I got passed again. It’s only a point.

Federer won 80% of his matches but only 54% of the points in those matches.

Crazy, right?!

One of the most dominant tennis players of all-time won most of his matches but not always in dominating fashion. It was more like slight advantages over the short-run that compounded through consistency over the long-run.

Of course, when I heard this part of the speech, my finance brain immediately went to the stock market. Federer’s win and point percentage are basically the same as those of the stock market! I’m always banging the drum about the fact that the stock market is essentially a toss-up in the short-term but has a wonderful win rate in the long-term.

On a daily basis over the past 100 years or so, the S&P 500 has been flat or up roughly 54% of the time, just like Federer:

Shockingly, the average down day is a little worse than the average up day is good.

Despite an average daily return of just three basis points, the stock market’s compounding over longer time horizons has been breathtaking.

These daily numbers are price-only (meaning no dividends). On a price-only basis, the S&P 500 is up close to 39,000% since 1927.

The average dividend yield in that time was just shy of 3.7%. With dividends reinvested, the total return since 1927 jumps to a staggering 1.3 million percent.

I know no one actually has a time horizon that long but the benefits of compounding can be remarkable if you can just stay out of your own way.

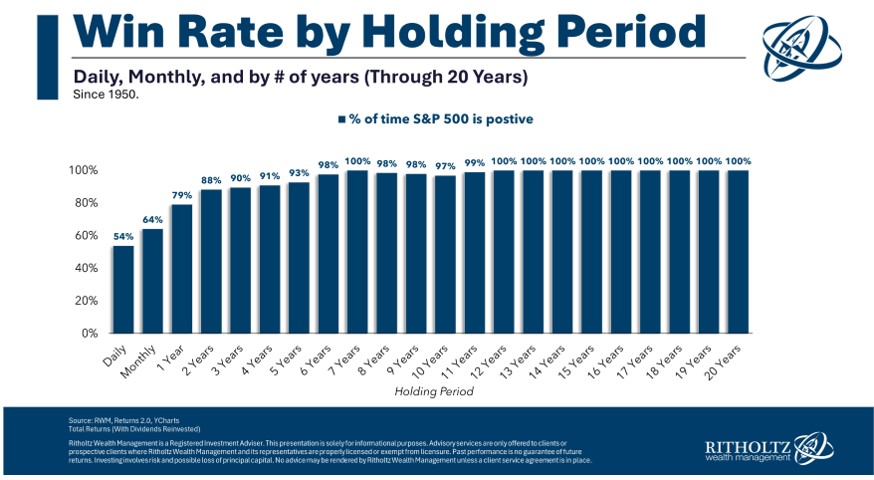

And the win rate gets higher the further out you go:

If Federer gave up every time he lost a point, tiebreaker or set, he wouldn’t have 20 grand slam titles.

If you put too much weight on short-term outcomes in the stock market, it’s hard to be a successful investor.

Minor advantages that compound over long time horizons can do wonders.