Blog

“Robo Advisor vs. Financial Advisor”

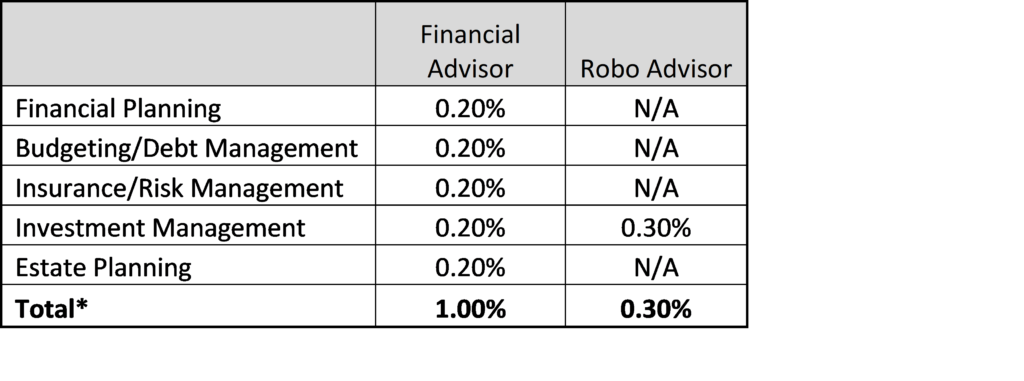

There has been a lot of debate, especially over the last 10 years, about the “value” that a real-life financial advisor brings to a client. During this time, the massive growth of rob-advisors such as Betterment, Ally, Ellevest, and many others has meant that traditional financial advisors feel like they are in a price war to the bottom in order to compete. However, in order to really compare the cost of a robo-advisor to that of a financial advisor, you have to compare apples with apples. What Services do I get with Each? With most robo-advisors the fee that you pay is strictly for investment management. In other words, you invest some money into their platform, and they will provide rebalancing services, tax loss harvesting, or specific fund allocations based on your risk tolerance. For this type of “advice,” fees tend to range between .25% and .50% for the funds you have under management. With an independent financial advisor, you also receive this same investment management service in addition to comprehensive financial planning, budgeting/debt management, insurance planning, estate planning, and more often than not some sort of college-based planning. For these services, the typical financial advisor fee is around 1%. How Should I Compare the Two? The reality is that the services provided are very different, and a chart like the one below helps to put things into perspective. Most Financial Advisors will indeed charge that 1% fee but end up providing services which are far more comprehensive than simply “investment management” advice. *For Illustrative purposes only. Most advisors will charge a flat % fee for ALL of their services, but the peace meal pricing shown here is mean to provide a comparison to ALL aspects of financial advice and not just investment management.

Which Should I Choose?

The reality is that there is not one right answer for everyone. For those looking purely for investment management and NOTHING else, then I think robo advisors are an interesting alternative. For others who are seeking a holistic financial advice approach around all aspects of their money, then it is tough to compete with the traditional financial advisor pricing.

If you, or someone you know, is ready to get their finances in order and is looking for holistic financial advice, reach out to one of our advisors today. Not only do we offer fee-based pricing as a % of assets under management, but we also have monthly subscription pricing models for those seeking advice before they have a significant asset base.

*For Illustrative purposes only. Most advisors will charge a flat % fee for ALL of their services, but the peace meal pricing shown here is mean to provide a comparison to ALL aspects of financial advice and not just investment management.

Which Should I Choose?

The reality is that there is not one right answer for everyone. For those looking purely for investment management and NOTHING else, then I think robo advisors are an interesting alternative. For others who are seeking a holistic financial advice approach around all aspects of their money, then it is tough to compete with the traditional financial advisor pricing.

If you, or someone you know, is ready to get their finances in order and is looking for holistic financial advice, reach out to one of our advisors today. Not only do we offer fee-based pricing as a % of assets under management, but we also have monthly subscription pricing models for those seeking advice before they have a significant asset base.Copyright © 2025

Van Gelder Financial