Blog

“Innovation is not a USA Only Story”

With incredible growth stock performance across many US companies over the past few years, it could be easy to assume that America is the best place to invest for future growth. However, if you were under the impression that all of the most innovative companies in the world are based in the United States, try paying for everything you buy on a daily basis using a single smartphone application. That’s a challenging task in the U.S., but it’s commonplace in China, South Korea and other Asian countries that have rapidly adopted digital payment technology on a wide scale. These days, Asia and Europe lead the world in some of tomorrow’s technology, and it may take a while for the U.S. to catch up.

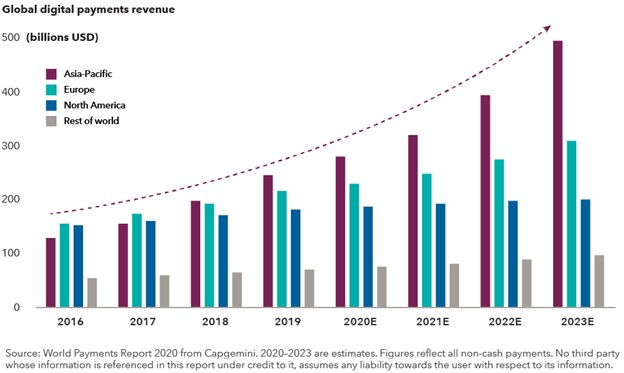

Asia has quickly become the world leader in digital payments

Simply put: Cash is no longer king, especially outside the U.S. Innovation in digital payments has gained far more traction abroad. For example, in some emerging markets just a few years ago, many customers had no bank accounts, but they did have mobile phones — and that led to faster adoption of mobile payments. In China, Alipay (part of Ant Financial) and Tenpay (run by Tencent) are dominate players. Others also have emerged and experienced strong growth in demand for their services, including Yeahka in China and PagSeguro and StoneCo in Brazil, which offer mobile payment platforms for merchants.

The COVID-19 crisis has accelerated the use of mobile payments, not only in emerging markets but around the world, as consumers embrace the concept of “contactless” transactions. In the U.S., companies like Mastercard and PayPal are poised to benefit as consumers become increasingly comfortable with the technology.

“A decade from now, I think digital payments will be the norm and people will give you odd looks if you try to pay with cash,” says equity portfolio manager Jody Jonsson.

Investing without borders

This powerful trend is just another reminder why investors shouldn’t ignore opportunities in international and emerging markets. While the U.S. is likely to remain a primary engine for innovation, it would be shortsighted to think of the U.S. as the sole province of inventive companies. What’s more important for investors is to seek out the world’s most innovative companies in growing industries wherever they are located.

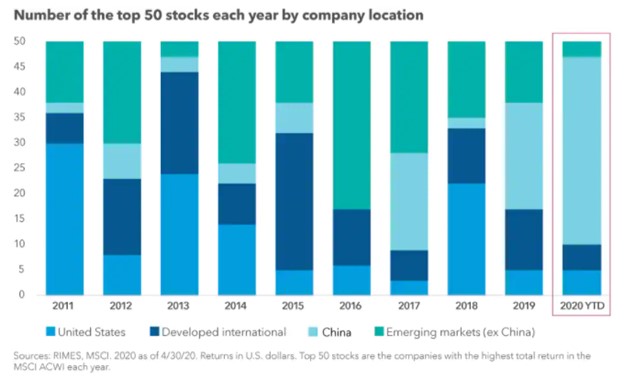

While international and emerging markets indexes have lagged U.S. markets over the past decade, on a company-by-company basis, the individual stocks with the best returns have been overwhelmingly located in non-U.S. markets.

That’s true over longer periods, and it’s also true in the most recent quarter when Asian stocks far outpaced the overall market, led by Chinese tech giant Alibaba, chipmaker Taiwan Semiconductor and China’s fast-growing food delivery company Meituan.

In fact, there is so much innovation happening overseas that venture capital funding has been growing at a faster pace outside the United States. Part of that is a function of valuations, which are generally cheaper outside the U.S., but it’s also clear that professional early-stage investors are increasingly finding compelling new opportunities elsewhere.

Has the U.S. dollar peaked?

At some point, the decade-long dollar bull market will come to an end. And there is some evidence that might already be happening. On a year-to-date basis as of November 20, the dollar is down 5% against the euro and 4% against the yen.

That’s largely due to investor worries about ballooning U.S. government debt, near-zero interest rates and a muddled economic picture. Timing the exact start of a currency cycle is notoriously difficult, but if this declining dollar trend continues it could provide a nice tailwind for international and emerging markets equities. Likewise, global bond sectors, such as emerging markets debt, could become more attractive.

In summary, it’s important to look outside of the US borders when considering investment opportunities. While America has produced some of the best overall stock market returns in the past few years, it’s a trend that likely won’t continue forever.