“Highlights from Coronavirus Stimulus Package”

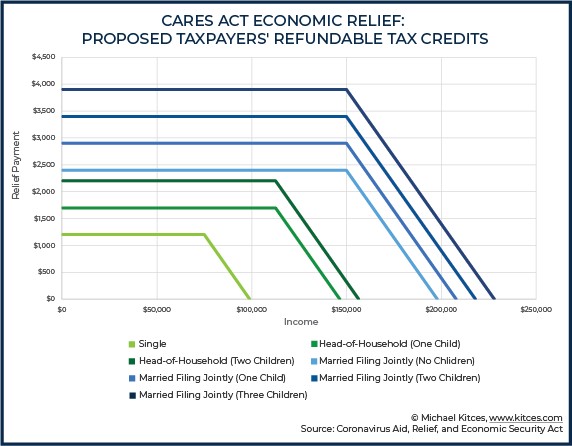

The recent $2.2 Trillion stimulus package approved by the federal government is the single largest package in our country’s history. It shows that the federal government is taking this virus very seriously, and highlights the impending economic difficulties that will be felt across the board. The stimulus package has a lot of information and details on how it will assist small and large businesses to “bridge the gap” between now and recovery, but it also has significant provisions for the induvial as well. In this post, we will take a look at some of the highlights of the bill and how they are likely to impact individuals across the country. Recovery Rebates I don’t think any single provision in the CARES act has received as much attention as the Recovery Rebates for Individuals Section 2201. As a starting point, the CARES act provides a refundable income tax credit against 2020 income of up to $2,400 for a married couple who files their taxes jointly. Single filers are eligible for up to $1,200 of rebates. Additionally, the credit amount is then increased by $500 for each child a taxpayer has under the age of 17. However, there are income threshold amounts to be eligible for these rebates and they are as follows: Married Joint: $150,000 Head of Household: $112,500 All Other Filers: $75,000 For every $100 over these income threshold limits, your rebate amount will be reduced by $5. In other words, 5% of every $1 made over the threshold will be reducing your eligible benefit. The chart below shows how each filing status would eventually phase out to $0 of eligibility. Your income will be based on your Adjusted Gross Income (AGI) from your most recently filed tax return (likely 2018 or 2019) so if you are close to the income threshold and made less money in 2019 compared to 2018 then you are encouraged to file your 2019 returns as soon as possible. Coronavirus Related Distributions

Similar to relief that has been provided to disaster areas in the past, the CARES act creates Coronavirus-related distributions. These are distributions of up to $100,000, made from IRA’s, employer sponsored retirement plans (401K’s), or a combination of both which can be made in 2020 to individuals directly impacted by the virus. Impacted means one of the following:

Coronavirus Related Distributions

Similar to relief that has been provided to disaster areas in the past, the CARES act creates Coronavirus-related distributions. These are distributions of up to $100,000, made from IRA’s, employer sponsored retirement plans (401K’s), or a combination of both which can be made in 2020 to individuals directly impacted by the virus. Impacted means one of the following:

- Have been diagnosed with COVID-19;

- Have a spouse or dependent who has been diagnosed with COVID-19;

- Experience adverse financial consequences as a result of being quarantined, furloughed, being laid off, or having work hours reduced because of the disease;

- Are unable to work because they lack childcare as a result of the disease;

- Own a business that has closed or operate under reduced hours because of the disease; or

- Meet some other reason that the IRS decides to say is OK

- Exempt from the 10% Penalty – Individuals under age 59 ½ may access these funds without incurring an additional penalty

- Not subject to mandatory (20%) federal tax withholding requirements

- Eligible to be repaid over 3 years – this can simply be rolled back into their retirement account through a single rollover or multiple rollovers in that three year period.

- Income can be spread over 3 years – By default, the income from a Coronavirus-Related Distribution is split evenly over 2020, 2021, and 2022. A taxpayer can, however, elect to include all of the income from a Coronavirus-Related Distribution in their 2020 income.

April 3rd, 2020

Copyright © 2025

Van Gelder Financial