Behavioral Finance

A Recession Won’t Help the Budget

Blog“A Recession Won’t Help the Budget" Every so often I come across a theory that makes sense superficially but on closer examination doesn’t add up. The most recent one is that the current Administration wants a recession (or at least wouldn’t mind one) because...

Your Goals > Stock Market Movements

Blog“Your Goals > Stock Market Movements" Investors are nervous right now. For those who’ve been reading our weekly articles for some time, you might recognize the above title. We have re-visited the idea that your personal goals should hold a greater weight in...

Humility Comes with Experience

Blog“Humility Comes with Experience" The more time I spend in finance, the more I realize how little we truly know or how foolish it is to try and predict what is going to take place. I’m convinced that if someone is absolutely certain of their belief of what will...

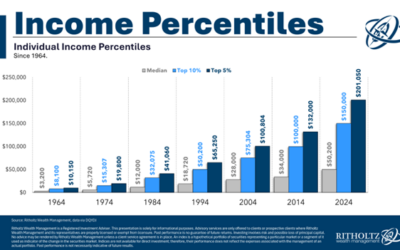

What’s Considered a High Income These Days?

Blog“What's Considered a High Income These Days?" The comparison trap is dangerous. Whether we are looking at our neighbor's car, or the houses in “that fancy party of town”, comparing our situation to others can have negative effects. So, my goal for this article...

Increase your Financial Knowledge with Free Online Classes

BlogIncrease your Financial Knowledge with Free Online Classes The topic of finance can be daunting for many people, but in our information age we have more opportunities than ever to tap into free financial knowledge online. Whether you are looking to simply make...

4 Money Lessons They Should Teach in High School

Blog“4 Money Lessons They Should Teach in High School" Growing up in America we are taught many valuable things in high school, but an area that has historically been ignored is personal finance. While Chemistry is almost always on the curriculum (I haven’t had to...

Leasing vs. Buying Your Next Car

Blog“Leasing vs. Buying Your Next Car” With the used and new car market being an interesting space right now, I thought this article from Eric Roberge at “Beyond Your Hammock” did a great job breaking down the age-old question of leasing vs. buying your next car. If...

Thoughts on this Weeks Volatility

Blog“Thoughts on this Weeks Volatility" I’m writing this on Tuesday, August 6th so take the context into account as you read this on Friday morning but we’ve already had a busy week in the market. I find it helpful to always take a step back, breathe, and put market...

Roger Federer vs. the Stock Market

Blog“Roger Federer vs. the Stock Market" If someone has a large amount of money to invest, it can sometimes be easier psychologically to put that money to work slowly over time. In other words, rather than investing $500,000 in one day, it can feel better to invest...

“Bearish is Easier than Bullish”

Blog“Bearish is Easier than Bullish" No matter what is happening in the markets or wider economy it seems you can always make a case for why the market is about to crash or why we are set for another bull run. 10 different advisors or economic “experts” can view the...

Why the Stock Market Isn’t a Casino

Blog “Why the Stock Market Isn’t a Casino" I’ve heard people say before that the stock market is simply organized gambling and while I understand the sentiment I would have to disagree especially when you take into account the time it takes for a bet to play...

“Consistency is Attractive”

Blog“Consistency is Attractive" In the age of social media, it’s so easy to get caught up in what the latest trends are and then adjust to ensure your life is oriented towards those trends. Older generations can claim that it is a “millennial” issue but keeping up...

Are we Living in the Roaring 20’s?

Blog“Are we Living in the Roaring 20’s?" With all of the negative headlines that are easy to pick up on and read about on the news it can sometimes be lost on us what we are currently experiencing. Coming out of COVID in 2020, net worths are at all time highs, stock...

Humility Comes with Experience

BlogHumility Comes with Experience The more time I spend in finance, the more I realize how little we truly know or how foolish it is to try and predict what is going to take place. I’m convinced that if someone is absolutely certain of their belief of what will...

Your Goals > Stock Market Movements

Blog“Your Goals > Stock Market Movements” For those who’ve been reading our weekly articles for some time, you might recognize the title. We have re-visited the idea that your personal goals should hold a greater weight in your mind than what is happening in the...

5 Keys to Investing in 2024

Blog"5 Keys to Investing in 2024" I enjoyed reading this recently published piece from American Funds. Yes, there are concerns as we enter into 2024, but is there ever a perfect time to invest?? What a difference a year makes. At the start of 2023, market pessimism...

Retirement for the Next Generation

BlogRetirement for the Next Generation We have written posts in the past about setting your children up for retirement which you can find here. In this article, we wanted to dive in deeper to this concept of a Custodial IRA (sometimes called a minor IRA). I also...

“Stocks have a Case of Bad Breadth”

Blog“Stocks have a Case of Bad Breadth" ‘Market-breadth’ refers to the number of companies responsible for driving the returns of the overall market. If a small number of companies account for the vast majority of the market’s (or an index’s) return over a...

Year-end Tax Planning

Blog “Year-end Tax Planning" As the calendar year winds down, it's the perfect time to think about your finances and make strategic moves to reduce your tax bill. Here are some straightforward year-end tax planning ideas that many should consider well before December...

“How Much is Enough?”

Blog“How Much is Enough?" This question is always relative. How we answered this question in our 20’s might be very different to how we answer in our 40’s, 50’s or beyond. Additionally, who we hang around and compare ourselves to (dangerous!) also plays a big...

“America’s Problems are Relative”

Blog “America’s Problems are Relative” Not many people would argue with you if you said that America is a great place to live but also has many problems. Whether it’s our national debt, inflation, interest rates, or political division, it can be easy to assume that...

“Good and Bad News About the Economy”

Blog “Good and Bad News About the Economy" It is hard to decide which voices you listen and ultimately which voices guide your line of thinking and decision making. I thought this recent article from Ben Carlson at a Wealth of Common Sense did a great job...

“How Americans Save, Spend and Invest”

Blog "How Americans Save, Spend and Invest" Ever since the pandemic hit us in early 2020, something that has been very interesting to watch is how Americans save, spend, and invest their money. While during COVID lockdowns, our spending choices looked...

Caring for Elderly Family Members

Blog Caring for Elderly Family Members Often referred to as a “sandwich generation” there are many adults these days that are caring for both their own children as well as aging family members. Whether you have kids of your own, or they are already grown and...

Van Gelder Financial

Curious to know more?

We offer a free 30 minute introductory call for those interested in becoming clients with Van Gelder Financial. During this call we will ask a lot of questions and answer any that you may have to ensure there is a match.

Subscribe to the Weekly Financial Thought!

Check the background of investment professionals on FINRA’s BrokerCheck.