Blog

A Recession Won’t Help the Budget

Blog“A Recession Won’t Help the Budget" Every so often I come across a theory that makes sense superficially but on closer examination doesn’t add up. The most recent one is that the current Administration wants a recession (or at least wouldn’t mind one) because...

Your Goals > Stock Market Movements

Blog“Your Goals > Stock Market Movements" Investors are nervous right now. For those who’ve been reading our weekly articles for some time, you might recognize the above title. We have re-visited the idea that your personal goals should hold a greater weight in...

Humility Comes with Experience

Blog“Humility Comes with Experience" The more time I spend in finance, the more I realize how little we truly know or how foolish it is to try and predict what is going to take place. I’m convinced that if someone is absolutely certain of their belief of what will...

8 Important Ages for Retirement Planning

Blog“8 Important Ages for Retirement Planning" The amount of decisions and timeframes that arrive at your doorstep as you head into retirement can be overwhelming. It’s hard to keep track of what age you become eligible for Medicare vs. when you can take social...

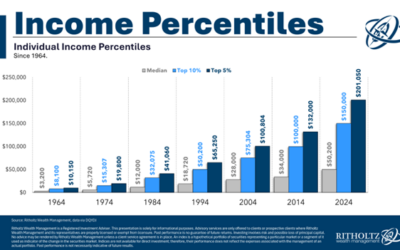

What’s Considered a High Income These Days?

Blog“What's Considered a High Income These Days?" The comparison trap is dangerous. Whether we are looking at our neighbor's car, or the houses in “that fancy party of town”, comparing our situation to others can have negative effects. So, my goal for this article...

Housing Market Outlook for 2025

Blog“Housing Market Outlook for 2025" As we kick off another year, I’m filled with optimism. Not because I think everything will be smooth sailing, but because even if we have a tough year, the economy has proven resilient over the long-term and this will be another...

Increase your Financial Knowledge with Free Online Classes

BlogIncrease your Financial Knowledge with Free Online Classes The topic of finance can be daunting for many people, but in our information age we have more opportunities than ever to tap into free financial knowledge online. Whether you are looking to simply make...

Policy Shifts Expected after Trump Wins Presidency

Blog“Policy Shifts Expected after Trump Wins Presidency" The magnitude of U.S. President-elect Donald Trump’s victory last week brings the strong likelihood he will have a mandate for his economic, market and foreign policy agenda. Winning the Electoral College and...

Tips for Lowering Taxes in Retirement.

Blog"Tips for Lowering Taxes in Retirement" So many financial articles talk about the importance of saving for retirement and how much money you should have saved to retire comfortably. While that is certainly an important topic, considering how these savings will be...

Don’t Live with Election Fear

Blog“Don’t Live with Election Fear" I thought it was high time to harken back to 2020 and remind everyone that regardless of our biases and desires, living with election fear when it comes to our investing usually doesn’t end up well! I hope you enjoy reading over...

4 Money Lessons They Should Teach in High School

Blog“4 Money Lessons They Should Teach in High School" Growing up in America we are taught many valuable things in high school, but an area that has historically been ignored is personal finance. While Chemistry is almost always on the curriculum (I haven’t had to...

Leasing vs. Buying Your Next Car

Blog“Leasing vs. Buying Your Next Car” With the used and new car market being an interesting space right now, I thought this article from Eric Roberge at “Beyond Your Hammock” did a great job breaking down the age-old question of leasing vs. buying your next car. If...

Roth IRA Considerations for the High-Income Earner

BlogRoth IRA Considerations for the High-Income Earner Firstly, I’m amazed we are already in October! It seems like 2024 just started, but alas we are only 3 months away from entering a new year. As we think about how quickly time flies, it’s good to...

The Fed Cut Rates…Now What?

Blog“The Fed Cut Rates…Now What?” Please enjoy this recent article from Pramod Atluri at Capital Group The U.S. Federal Reserve has finally arrived at the rate-cut party. Officials at the central bank lowered interest rates 50 basis points to 4.75% to 5.00%, the first...

Stock Markets and Presidential Elections

Blog“Stock Markets and Presidential Elections” While our post this week might not directly assist you in your quest towards financial independence, it’s still interesting to see how finances can play into so many aspects of our world. If 2024 hasn’t already been...

529’s are no Longer Just for College

Blog529’s are no Longer Just for College 529 savings plans used to be something you saved in ONLY for future college expenses. While that still might be the majority of the reason that someone would save money into a 529 plan, it certainly doesn’t tell the...

Caring for Elderly Family Members

BlogCaring for Elderly Family Members Often referred to as a “sandwich generation” there are many adults these days that are caring for both their own children as well as aging family members. Whether you have kids of your own, or they are already grown and...

Housing for 2nd Half of the Year

BlogHousing for 2nd Half of the Year At the beginning of the year we put out a 2024 housing outlook that First Trust published. In that report it talked about how unique 2023 was for housing but also an expectation for home sales to pick up in 2024 with expected...

Thoughts on this Weeks Volatility

Blog“Thoughts on this Weeks Volatility" I’m writing this on Tuesday, August 6th so take the context into account as you read this on Friday morning but we’ve already had a busy week in the market. I find it helpful to always take a step back, breathe, and put market...

A History of the Federal Funds Rate

Blog“A History of the Federal Funds Rate" There is a lot of talk about the Federal Funds rate recently and whether or not the Federal Reserve will lower interest rates in 2024. I thought this recent article from Yahoo Finance did a good job explaining the history of...

Is the AI Fever Too Hot?

Blog“Is the AI Fever Too Hot?" I get a lot of questions about Artificial Intelligence and whether clients think we should be investing more heavily in some of these companies. While the growth has certainly been eye-catching, it’s important to not get caught up in the...

Why America is Still a Safe Bet

Blog“Why America is Still a Safe Bet" Over the past few years I regularly get asked if I think that America is in a downward spiral and whether investing in our future is still a safe bet. While I understand the question, and I don’t think you can argue that the...

Why the Stock Market Isn’t a Casino

Blog“Why the Stock Market Isn’t a Casino" I’ve heard people say before that the stock market is simply organized gambling and while I understand the sentiment I would have to disagree especially when you take into account the time it takes for a bet to play out in a...

Roger Federer vs. the Stock Market

Blog“Roger Federer vs. the Stock Market" If someone has a large amount of money to invest, it can sometimes be easier psychologically to put that money to work slowly over time. In other words, rather than investing $500,000 in one day, it can feel better to invest...

Van Gelder Financial

Curious to know more?

We offer a free 30 minute introductory call for those interested in becoming clients with Van Gelder Financial. During this call we will ask a lot of questions and answer any that you may have to ensure there is a match.