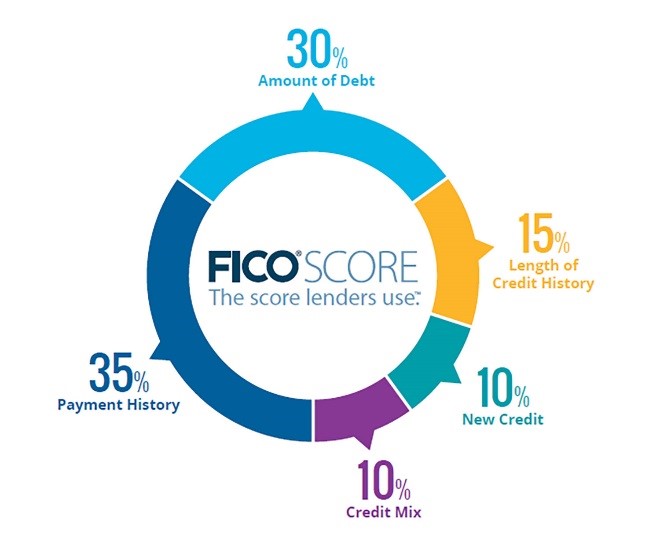

“How is my Credit Score Calculated?”

Many people live and die by their credit score and do everything humanly possible to improve it. Others take a more passive approach and just try to ensure they pay off their credit card every month and trust they will be viewed in a good light the next time their report is pulled. I think that a healthy answer on your credit score is somewhere in the middle. While it’s important to understand how credit agencies will view your actions, your personal financial goals and dreams should be more important than taking your credit score from 650 to 700. In this article, we look to provide insight into how your credit score is actually calculated.

Payment History and Length of History (50%)

35% of everyone’s credit score is dependent on their payment history. Specifically, how often you are (or aren’t) paying your debts on time. This is the largest single factor that impacts your credit score and rightly so. Essentially, it tells a lender whether your track record is one they can trust if they loan you more money going forward. Secondly, the length of your credit history accounts for another 15% of your score. If you’ve had a credit history for decades (compared to one to two years) then you will be seen as more “trustworthy” in the eyes of a lender.

Another term that might make more sense here is what is your credit utilization? In other words, if you have a $5,000 limit on your credit card are you maxing it out every month or only putting $2,500 on there? For someone who owes back a lot of debt AND is close to 100% utilization on their available credit limits will be seen as a risky proposition compared to someone else who is managing this figure more prudently.

New Credit and Credit Mix (20%)

Your “Credit Mix” will contribute another 10% to your score. Do you JUST have a credit card but maybe not a mortgage or car loan? People who have a good mix of credit will be viewed in a better light than others. However, we do not recommend opening lines of credit that you don’t intend to use just to improve your score. Finally, “new credit” or how many new accounts you open is another 10% factory in your score. Avoiding opening a bunch of new accounts in a short amount of time can be helpful in keeping your credit score in a favorable light.

If you have significant purchases coming up where your credit score will be an important factor, then reach out to one of our financial advisors today to discuss!

September 6th, 2019